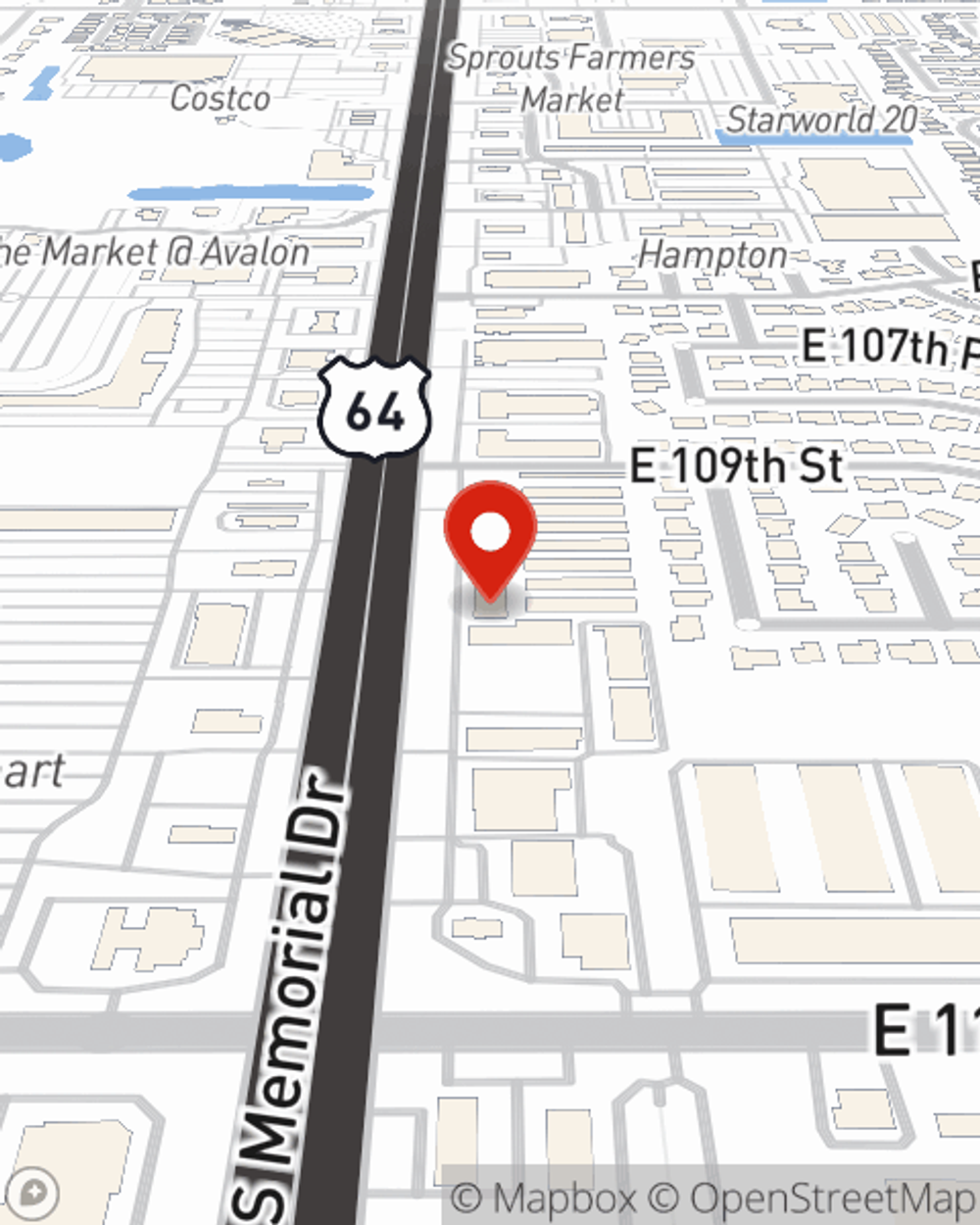

Business Insurance in and around Tulsa

Calling all small business owners of Tulsa!

Helping insure small businesses since 1935

- Tulsa

- Broken Arrow

- Coweta

- Jenks

- Bixby

- Moore

- Owasso

- Sapulpa

- Sand Springs

- Oklahoma City

- Beggs

- Glenpool

- Edmond

- Yukon

- Okmulgee

Insure The Business You've Built.

As a business owner, you have to think about all areas of business, all the time. The details can be overwhelming! You can maximize your efforts by working with State Farm agent Mike Thompson. Mike Thompson gets where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your concerns and frees you to focus on growing your business into the future.

Calling all small business owners of Tulsa!

Helping insure small businesses since 1935

Cover Your Business Assets

If you're looking for a business policy that can help cover business property, business liability, and more, State Farm may be able to help, just like they've done for other small businesses since 1935.

It's time to visit State Farm agent Mike Thompson. You'll quickly find out why State Farm is one of the leading providers of small business insurance.

Simple Insights®

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Mike Thompson

State Farm® Insurance AgentSimple Insights®

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.